CONNECTING DOTS...

CPA on demand — clarity, compliance, and consulting insight

On-Demand Controller & Business Consultant for SMEs

Clarity in Compliance. Confidence in Reporting. Cost-effective expertise without the overhead of a full-time hire.

gvaquino. connecting dots…

I’m Greg Aquino, CPA. With years of professional public practice in audit, compliance, and advisory, I now help SMEs gain clarity and confidence through on-demand controllership and consulting.

My mission is simple: deliver premium, flexible expertise that empowers SMEs to grow without the burden of a full-time hire. I believe that every business deserves tailored financial guidance that aligns with their unique goals. My commitment to continuous improvement ensures that we stay ahead of industry trends, providing you with innovative solutions that drive success. Together, we can navigate the complexities of finance and compliance, allowing you to focus on what you do best: running your business.

OFFERINGS

On-Demand Controllership

Compliance oversight monthly reporting

Audit preparation risk management

Workflow automation process improvement

Flexible hourly or monthly packages

Business Consulting

Compliance advisory statutory guidance

Team training mentorship for accounting staff

Strategic financial analysis for growth decisions

Process design system improvement

CORE FOCUS

Mission

To provide on-demand controllership and strategic consulting that simplify compliance, strengthen reporting, and equip SME teams with practical tools for success.

Vision

To empower SMEs with accessible, premium financial expertise—delivering clarity, compliance, and confidence so they can grow sustainably and compete globally.

My Core Values

Clarity

Simplifying compliance and reporting for SMEs.

Confidence

Giving business owners peace of mind in their numbers.

Accountability

Anchored in CPA ethics and professional practice.

Flexibility

On-demand support tailored to SME realities.

Latest News

Overview of the Revised Corporation Code of the Philippines

The Revised Corporation Code of the Philippines (RCC) is a landmark legislation that aims to...

How to Be a Tax-Savvy Influencer in the Philippines

Philippines - If you are a content creator who earns money from social media platforms such as...

The Pain of Graphing the FS—And How FS T-Graph Fixes It

“I tried turning the Balance Sheet into a chart… but it still didn’t make sense.”“These graphs...

What Is T-Graph? Why We Need Visual FS?

Most people are used to seeing financial statements as long tables full of numbers. They're...

Why Understanding Taxes Can Save You Money

Taxes—just the word can make some people feel overwhelmed. But what if understanding them actually...

Stay Compliant: Essential Guide to BIR Inventory List Submission

As the new year begins, it’s crucial for businesses to stay on top of their tax compliance...

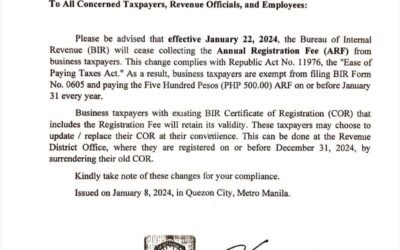

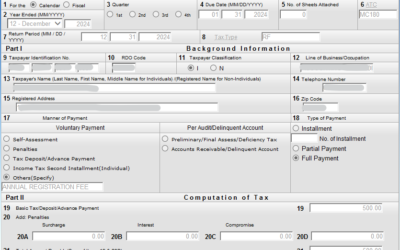

BIR Annual Registration Fee Scrapped: A Win for Filipino Businesses

What is the BIR Annual Registration Fee and Why Was It Abolished? If you are a registered taxpayer...

BIR Annual Registration (ARF) Due every 31st of January, ABOLISHED in 2024

Legal Basis For BIR Annual Registration National Internal Revenue Code (NIRC)Section 236(B)Annual...