Legal Basis For BIR Annual Registration

National Internal Revenue Code (NIRC)Section 236(B)Annual Registration Fee.— An annual registration fee in the amount of Five Hundred pesos (Php 500) for every separate or distinct establishment or place of business, including facility types where sales transactions occur, shall be paid upon registration and every year thereafter on or before the last day of January:Provided, however, That cooperatives, individuals earning purely compensation income, whether locally or abroad, and overseas workers are not liable to the registration fee herein imposed.

The registration fee shall be paid to an authorized agent bank located within the revenue district, or to the Revenue Collection Officer, or duly authorized Treasurer of the city or municipality where each place of business or branch is registered.

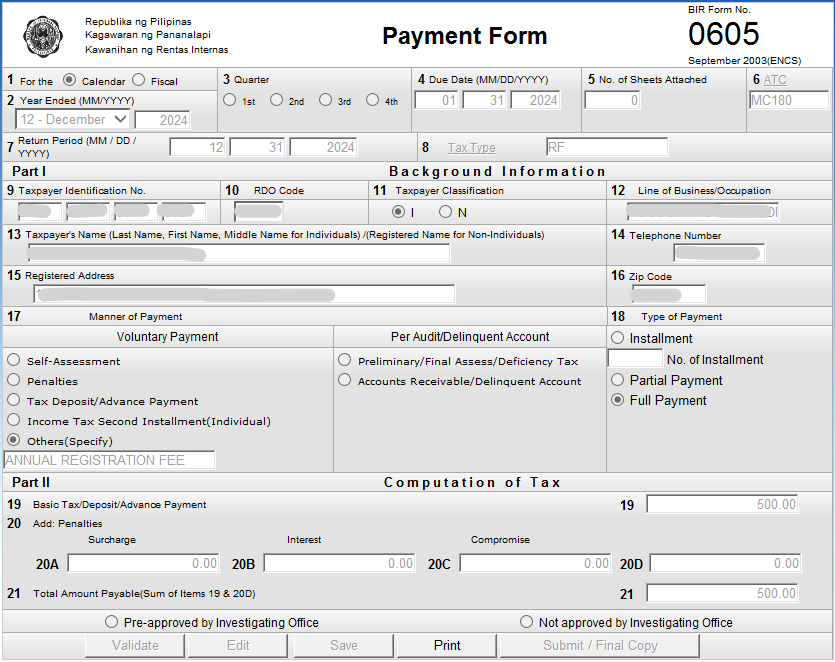

How to Fill Out BIR Form 0605 – Payment Form

Annual Registration Fee (ARF) is filed through BIR form 0605 with the following details:

- Item 4: Due Date – 01/31/YYYY

- Item 6: ATC – MC180 – Registration Fee for VAT/NON-VAT Taxpayers

- Item 7: Return Period – 12/31/YYYY

- Item 8: Tax Type Code – RF

- Item 17: Manner of Payment – Others “Annual Registration Fee”

- Item 18: Type of Payment – Full Payment

- Item 19: Basic Tax – Php 500.00

Other items in the BIR form 0605 will be filled-out depending on your company details such as year ending, RDO Code, TIN, Name, Address, etc.

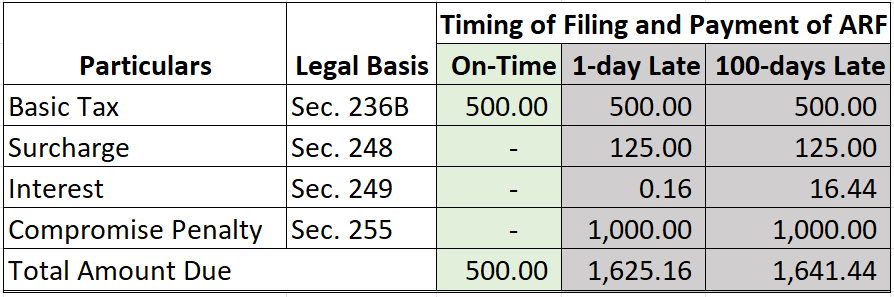

Penalty for Non-compliance or Late Filing of ARF

Business establishments cannot make an excuse in its failure to file and pay the BIR Annual Registration. Failure to file the ARF within the prescribed deadline is subject to the SIC system of BIR.

SURCHARGES

NIRC SEC. 248. – Civil Penalties. (A) There shall be imposed, in addition to the tax required to be paid, a penalty equivalent to twenty-five percent (25%) of the amount due, in the following cases:

(1) Failure to file any return and pay the tax due thereon as required under the provisions of this Code or rules and regulations on the date prescribed; or

(2) Unless otherwise authorized by the Commissioner, filing a return with an internal revenue officer other than those with whom the return is required to be filed; or

(3) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment; or

(4) Failure to pay the full or part of the amount of tax shown on any return required to be filed under the provisions of this Code or rules and regulations, or the full amount of tax due for which no return is required to be filed, on or before the date prescribed for its payment.

INTERESTS

NIRC SEC. 249. Interest. – (A) In General. – There shall be assessed and collected on any unpaid amount of tax, interest at the rate of twelve percent [12] per annum, or such higher rate as may be prescribed by rules and regulations, from the date prescribed for payment until the amount is fully paid. (The old 20% interest rate was amended under the Tax Reform Acceleration Inclusion [TRAIN] Law – Double the legal interest rate per annum… see RR 21-2018)

COMPROMISE PENALTY (Late Filing is Php1,000.00)

NIRC SEC. 255. Failure to File Return, Supply Correct and Accurate Information, Pay Tax Withhold and Remit Tax and Refund Excess Taxes Withheld on Compensation. – Any person required under this Code or by rules and regulations promulgated thereunder to pay any tax make a return, keep any record, or supply correct the accurate information, who willfully fails to pay such tax, make such return, keep such record, or supply correct and accurate information, or withhold or remit taxes withheld, or refund excess taxes withheld on compensation, at the time or times required by law or rules and regulations shall, in addition to other penalties provided by law, upon conviction thereof, be punished by a fine of not less than Ten thousand pesos (P10,000) and suffer imprisonment of not less than one (1) year but not more than ten (10) years.

Any person who attempts to make it appear for any reason that he or another has in fact filed a return or statement, or actually files a return or statement and subsequently withdraws the same return or statement after securing the official receiving seal or stamp of receipt of internal revenue office wherein the same was actually filed shall, upon conviction therefor, be punished by a fine of not less than Ten thousand pesos (P10,000) but not more than Twenty thousand pesos (P20,000) and suffer imprisonment of not less than one (1) year but not more than three (3) years.

COMPROMISE PENALTY (FAILURE TO DISPLAY THE ANNUAL REGISTRATION FEE )

Failure to display the Annual Registration Fee in a conspicuous area of the business establishment will be penalized for a fine of not more than Php 1,000.00 or imprisonment of not more than 6 months (Sec. 275 of NIRC, RMO 7-2015)

Compliance is Costly, Non-Compliance is Luxury

Here is the comparative assessment for on-time filing against the two scenarios of late filing (1-day late and 100-days late). To avoid paying more, we encourage you to file early on or before the due date (January 31st).

Trackbacks/Pingbacks