by Greg Aquino | Jun 28, 2025 | FS T-Graph

“I tried turning the Balance Sheet into a chart… but it still didn’t make sense.”“These graphs look good—but they don’t really explain anything.”“Isn’t there a better way to visualize all this?” If you’ve ever felt this, welcome. You’re among thousands who’ve...

by Greg Aquino | Jun 27, 2025 | FS T-Graph

Most people are used to seeing financial statements as long tables full of numbers. They’re written in columns, top to bottom, and not made for people to easily understand. They were built to follow rules—not to help someone see what’s going on.FS T-Graph...

by Greg Aquino | Jun 2, 2025 | Business Best Practices

Taxes—just the word can make some people feel overwhelmed. But what if understanding them actually helped you save money? The truth is, tax planning isn’t just for accountants and finance experts. When you grasp the basics of how taxes work, you can make smarter...

by Greg Aquino | Jan 7, 2025 | Business Best Practices, Compliance and Tax Updates

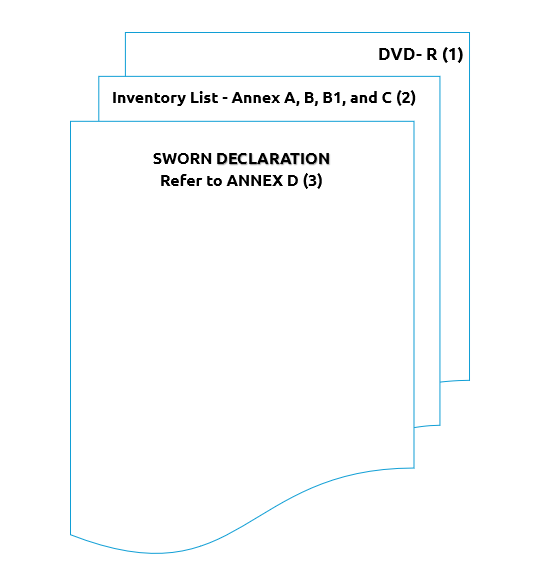

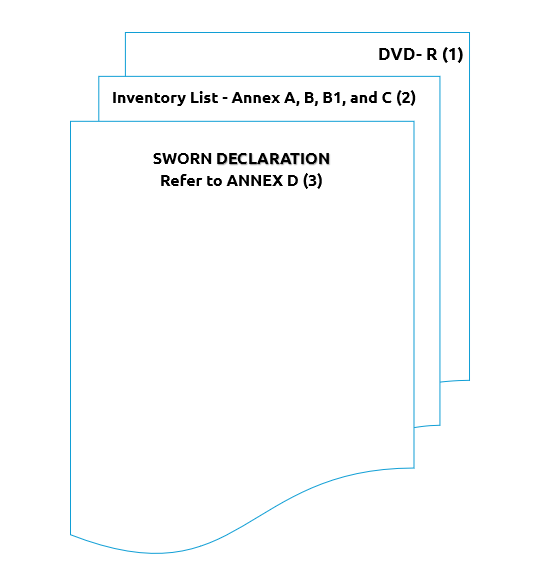

As the new year begins, it’s crucial for businesses to stay on top of their tax compliance requirements. One important task is the submission of the annual inventory list, as mandated by the Bureau of Internal Revenue (BIR) under Revenue Memorandum Circular (RMC) No....

by Greg Aquino | Jan 9, 2024 | Compliance and Tax Updates

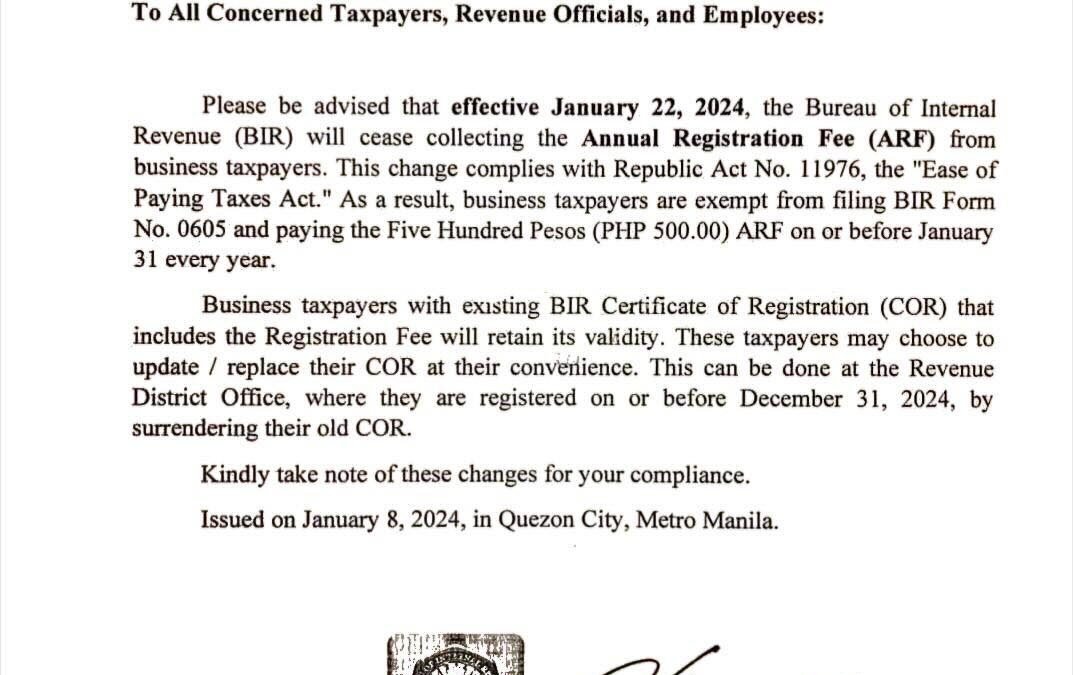

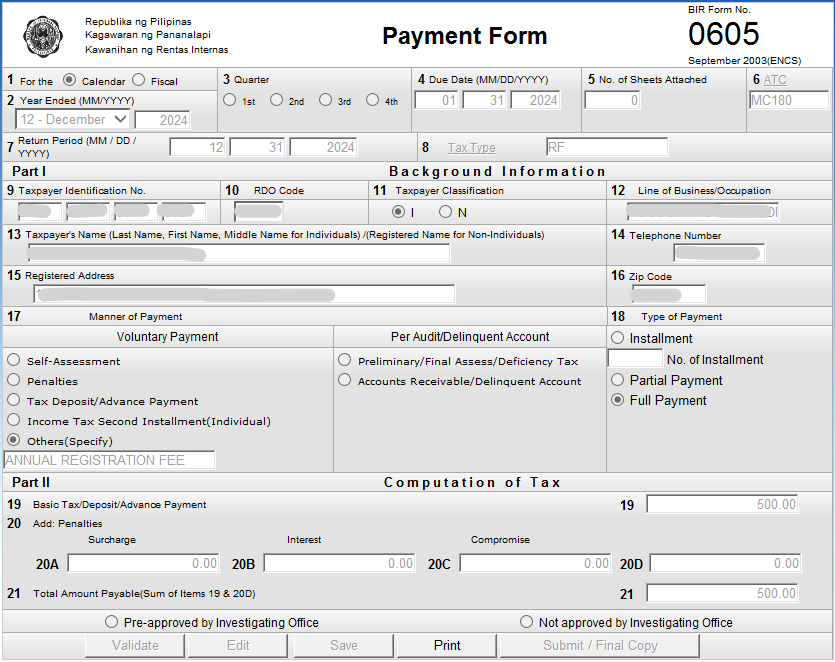

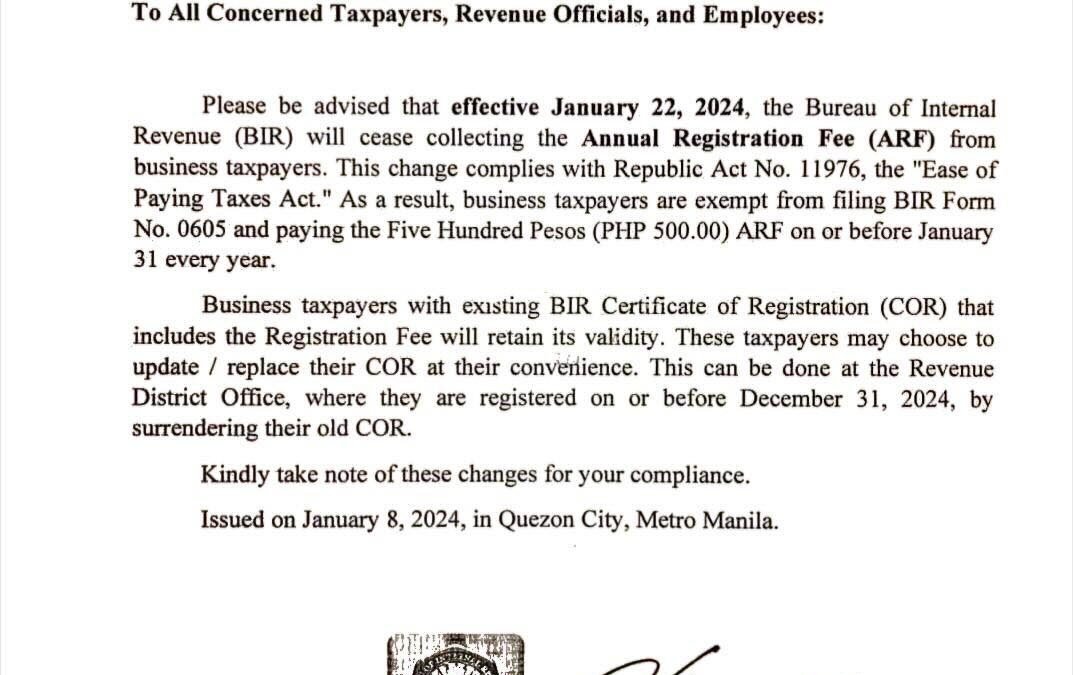

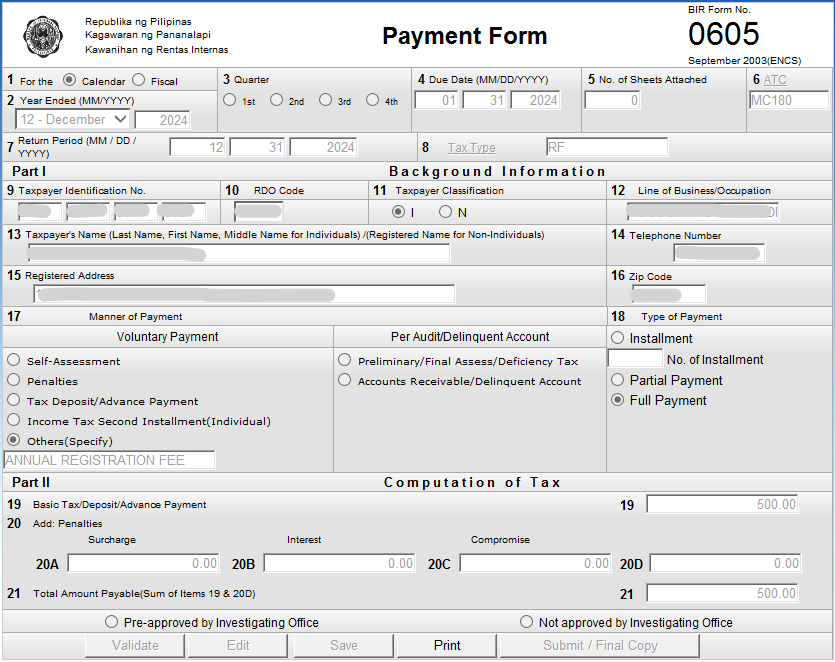

What is the BIR Annual Registration Fee and Why Was It Abolished? If you are a registered taxpayer in the Philippines, you know that every year, you have to pay a P500 annual registration fee (ARF) to the Bureau of Internal Revenue (BIR). This fee is supposed to renew...

by Greg Aquino | Jan 3, 2024 | Uncategorized

Legal Basis For BIR Annual Registration National Internal Revenue Code (NIRC)Section 236(B)Annual Registration Fee.— An annual registration fee in the amount of Five Hundred pesos (Php 500) for every separate or distinct establishment or place of business, including...

by Greg Aquino | Jul 4, 2023 | Compliance and Tax Updates

The Revised Corporation Code of the Philippines (RCC) is a landmark legislation that aims to modernize and streamline the rules and regulations governing corporations in the country. It was signed into law by President Rodrigo Duterte on February 20, 2019, and took...

by Greg Aquino | Jul 1, 2023 | Compliance and Tax Updates

Philippines – If you are a content creator who earns money from social media platforms such as Facebook, Instagram, YouTube, and others, you might be wondering how to deal with your taxes. In this article, we will discuss the tax guidelines for influencers in...

by Greg Aquino | Jun 30, 2023 | Uncategorized

This latest changes in the SEC amnesty program features the following: Extention of amnesty application until September 30, 2023; Removal of notarized Expression of Interest (EOI); No more Affidavit of Undertaking for Latest AFS Submission; 15 days turnaround time for...

by Greg Aquino | Jun 28, 2023 | Compliance and Tax Updates

Philippines — Out with the Old, In with the New: BIR’s Green Notice to Issue Receipt/InvoiceYou’ve probably seen the orange “Ask for Receipt” notice in many shops and businesses. This notice was put up by the Bureau of Internal Revenue...

by Greg Aquino | Dec 31, 2022 | Compliance and Tax Updates

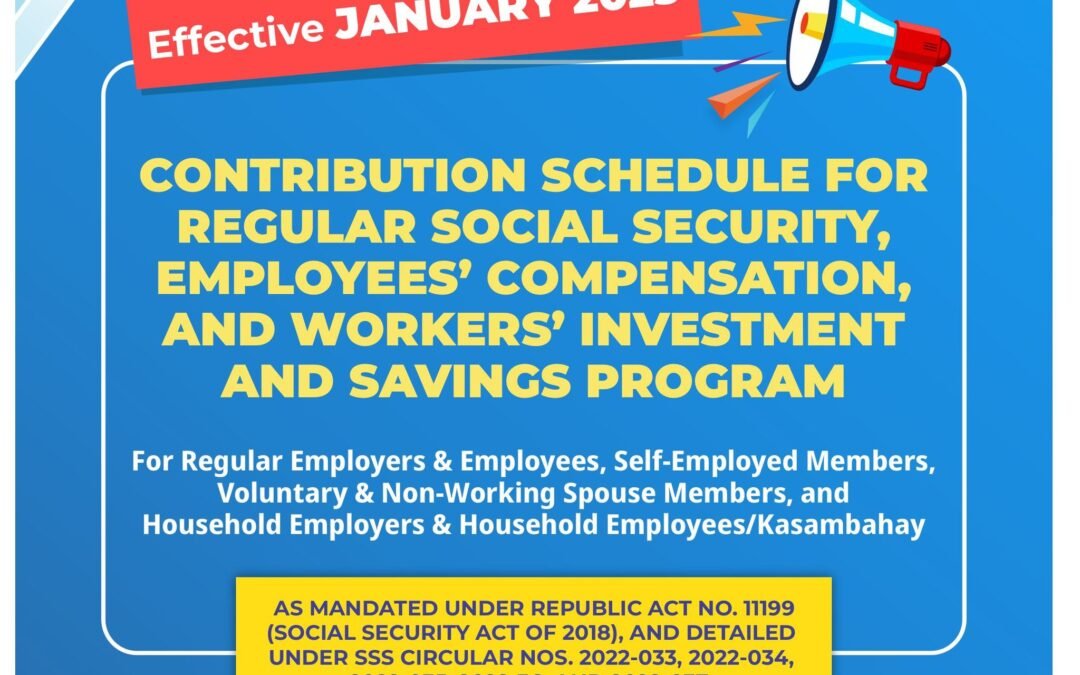

Philippines – Pursuant to Republic Act No. 11199 or the Social Security Act of 2018 which includes a provision that increases the SS contribution rate to 14% for the calendar year 2023, with a minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to...