What is the BIR Annual Registration Fee and Why Was It Abolished?

If you are a registered taxpayer in the Philippines, you know that every year, you have to pay a P500 annual registration fee (ARF) to the Bureau of Internal Revenue (BIR). This fee is supposed to renew your registration and maintain your compliance with the BIR. However, many taxpayers find this fee unnecessary, burdensome, and redundant, especially since they already pay other fees and taxes to the government.

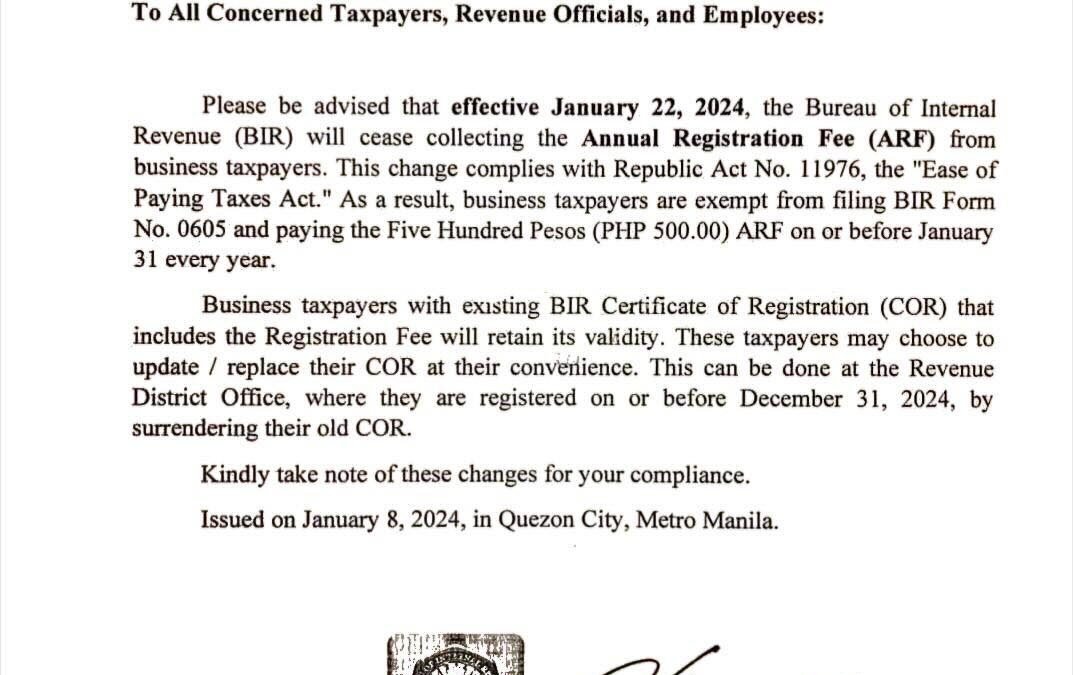

The good news is that the ARF has been abolished, thanks to a new law that aims to ease the tax burden of Filipino businesses. The law, known as the Ease of Paying Taxes Act, was recently signed by President Ferdinand R. Marcos Jr. after being approved by both the House of Representatives and the Senate. The law simplifies the tax system, reduces the number of tax forms and payments, and eliminates some taxes and fees, including the ARF.

How Does the Abolition of the ARF Benefit Filipino Businesses?

According to the law’s authors, the ARF was an outdated and unjustified fee that did not serve any purpose other than generating revenue for the BIR. They argued that the ARF was a form of double taxation, since taxpayers already paid for their business permits and licenses to the local government units (LGUs). They also pointed out that the ARF was a hassle for taxpayers, who had to fill out a separate form (BIR Form 0605) and pay the fee before the end of January every year.

The law’s proponents claim that scrapping the ARF will benefit Filipino businesses, especially the micro, small, and medium enterprises (MSMEs), who make up 99.5% of the country’s businesses. They say that the ARF was a significant cost for MSMEs, who had limited resources and cash flow. They also say that the ARF was a deterrent for new businesses, who had to pay the fee upon registration and every year thereafter. By abolishing the ARF, the law hopes to encourage more business activity, create more jobs, and boost the economy.

How Does the Abolition of the ARF Improve the Ease of Doing Business and Paying Taxes in the Philippines?

The law also aims to improve the ease of doing business and paying taxes in the Philippines, which ranks poorly in the global surveys. According to the World Bank’s Doing Business 2023 report, the Philippines ranks 124th out of 190 economies in the ease of doing business, and 94th in the ease of paying taxes. The report shows that Filipino businesses have to make 28 tax payments per year, spend 185 hours to comply with tax requirements, and pay 25.6% of their profits in taxes[^5^]. The law hopes to improve these indicators by simplifying and streamlining the tax system.

Conclusion: The Abolition of the ARF is a Welcome Development for Filipino Businesses

The abolition of the ARF is a welcome development for Filipino businesses, who have long been clamoring for tax relief and reform. The law is a step in the right direction, and it brings positive changes to the business sector and the economy as a whole.