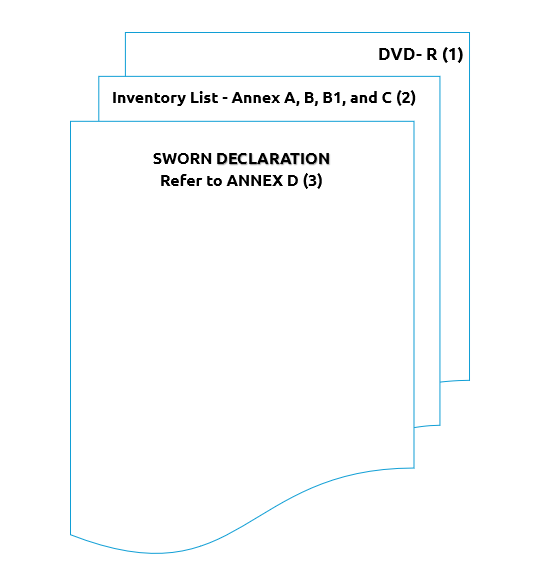

by Greg Aquino | Jan 7, 2025 | Business Best Practices, Compliance and Tax Updates

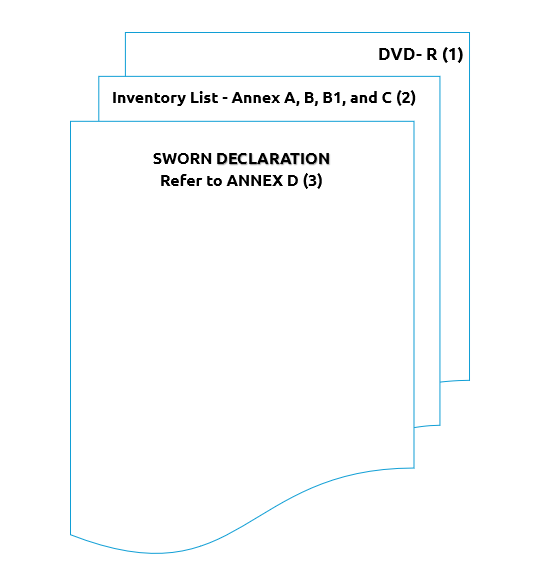

As the new year begins, it’s crucial for businesses to stay on top of their tax compliance requirements. One important task is the submission of the annual inventory list, as mandated by the Bureau of Internal Revenue (BIR) under Revenue Memorandum Circular (RMC) No....

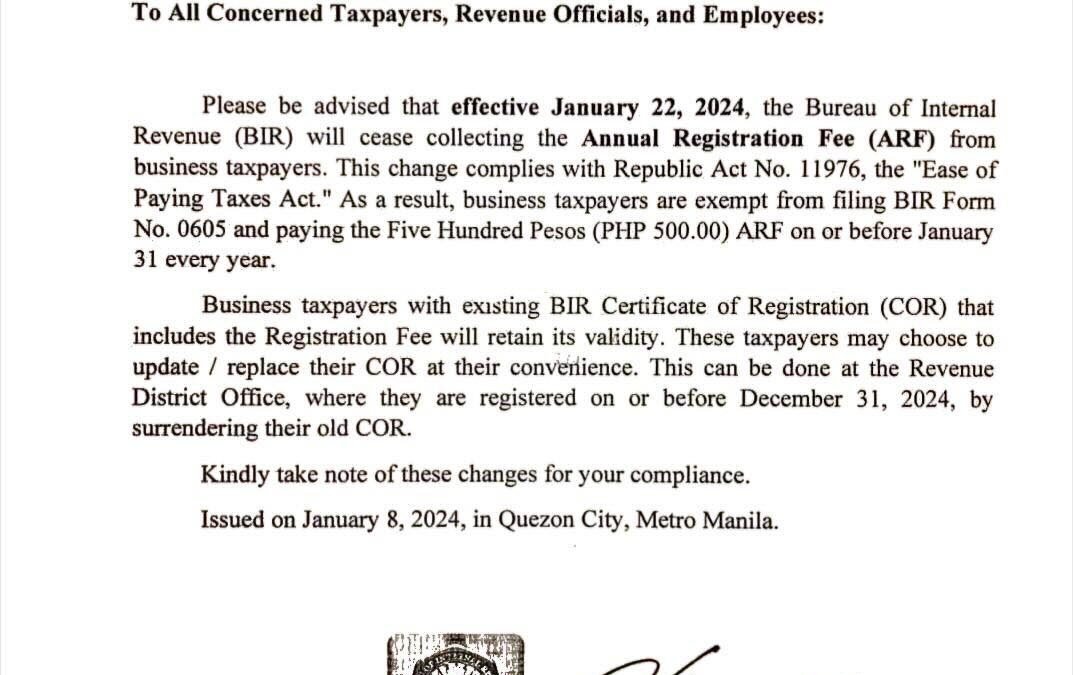

by Greg Aquino | Jan 9, 2024 | Compliance and Tax Updates

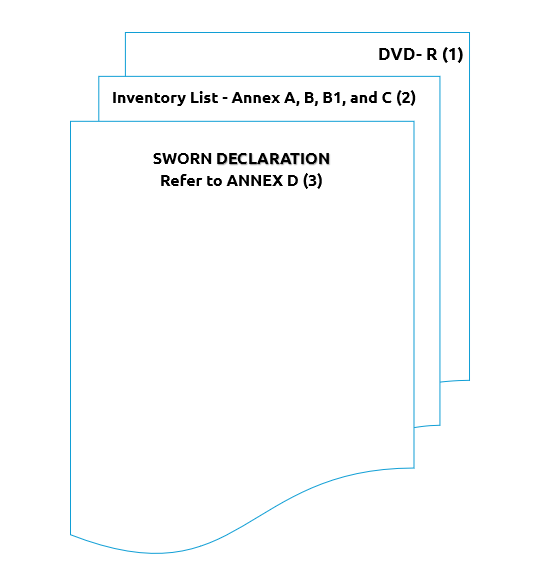

What is the BIR Annual Registration Fee and Why Was It Abolished? If you are a registered taxpayer in the Philippines, you know that every year, you have to pay a P500 annual registration fee (ARF) to the Bureau of Internal Revenue (BIR). This fee is supposed to renew...

by Greg Aquino | Jul 4, 2023 | Compliance and Tax Updates

The Revised Corporation Code of the Philippines (RCC) is a landmark legislation that aims to modernize and streamline the rules and regulations governing corporations in the country. It was signed into law by President Rodrigo Duterte on February 20, 2019, and took...

by Greg Aquino | Jul 1, 2023 | Compliance and Tax Updates

Philippines – If you are a content creator who earns money from social media platforms such as Facebook, Instagram, YouTube, and others, you might be wondering how to deal with your taxes. In this article, we will discuss the tax guidelines for influencers in...

by Greg Aquino | Jun 28, 2023 | Compliance and Tax Updates

Philippines — Out with the Old, In with the New: BIR’s Green Notice to Issue Receipt/InvoiceYou’ve probably seen the orange “Ask for Receipt” notice in many shops and businesses. This notice was put up by the Bureau of Internal Revenue...

by Glendarith Crispin | Jan 20, 2023 | Compliance and Tax Updates

PHILIPPINES – Baguio City- The start of the year 2023 signifies the time business owners can process the paperwork needed to conduct business. To make it easier for business owners, application and processing of business permit can be done through online or...

by Glendarith Crispin | Jan 13, 2023 | Compliance and Tax Updates

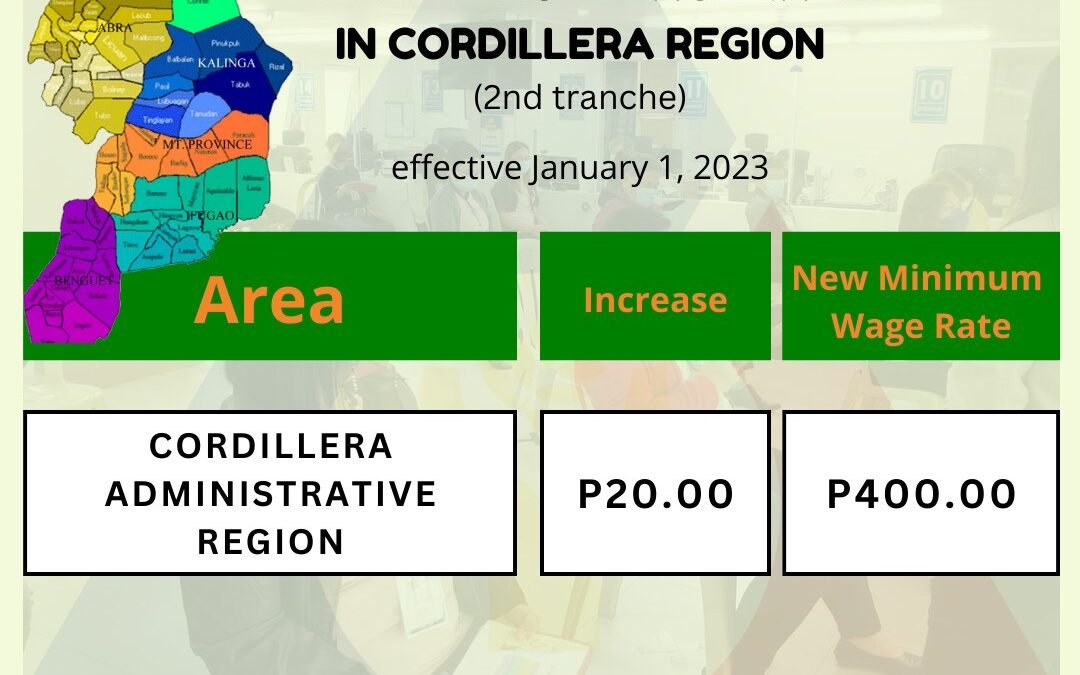

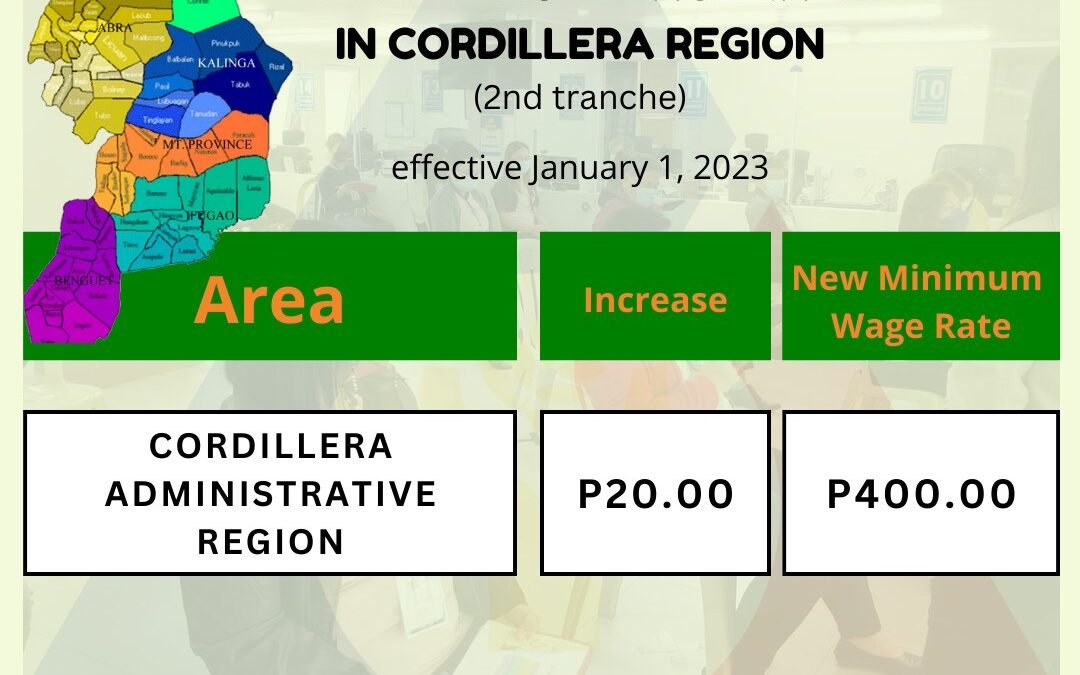

PHILIPPINES – Cordillera Administrative Region (CAR) – Effective January 1, 2023, minimum wage earners in the private sector in the region will receive twenty pesos (Php 20.00) increase in the basic wage per day bringing the prevailing minimum wage in the...

by Greg Aquino | Dec 31, 2022 | Compliance and Tax Updates

Philippines – Pursuant to Republic Act No. 11199 or the Social Security Act of 2018 which includes a provision that increases the SS contribution rate to 14% for the calendar year 2023, with a minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to...