Philippines — Out with the Old, In with the New: BIR’s Green Notice to Issue Receipt/Invoice

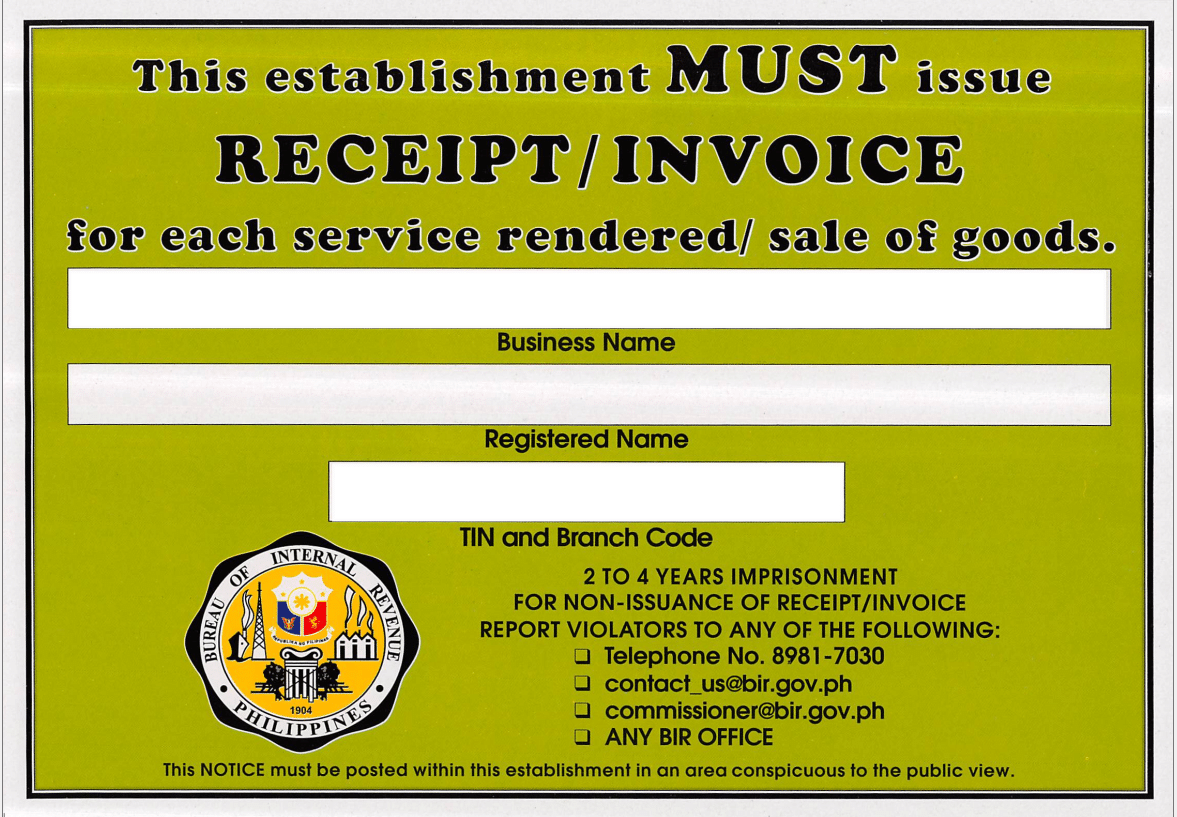

You’ve probably seen the orange “Ask for Receipt” notice in many shops and businesses. This notice was put up by the Bureau of Internal Revenue (BIR) to remind you to ask for receipts or invoices from sellers whenever you buy something.

But guess what? This notice is going to be replaced by a new one: say hello to the Notice to Issue Receipt/Invoice (NIRI). This is part of the BIR’s efforts to improve tax compliance and collection, especially from online businesses.

What is NIRI and why should you care?

NIRI is a green poster that requires sellers, including those who sell online, to issue receipts or invoices for the goods or services they sell. It also tells you that you have the right to demand receipts or invoices from sellers.

NIRI is important because it helps the BIR in encouraging businesses to issue receipts/invoices, especially those that operate online. It also helps you protect your rights and interests as a buyer and a taxpayer.

Who needs to follow NIRI and when does it start?

NIRI applies to all new and existing business registrants, including online sellers, vloggers, social media influencers, and online content creators who make money from platforms and/or advertising.

The NIRI issuance will follow a schedule based on the last digit of your Taxpayer Identification Number (TIN), as follows:

| TIN Ending | Month |

| 1 and 2 | Starting October 3, 2022 |

| 3 and 4 | Starting November 2, 2022 |

| 5 and 6 | Starting December 1, 2022 |

| 7 and 8 | Starting January 2, 2023 |

| 9 and 0 | Starting February 1, 2023 |

The old “Ask for Receipt” notice will still be valid until June 30, 2023. Starting July 1, 2023, the old orange decal is already phased-out and on this day onwards, NIRI should be posted as a replacement.

How do you get your NIRI and what do you need to do?

To get your NIRI, you need to update your registration information with the BIR before they give you your NIRI. You also need to give them an official company email address that they will use to communicate with you.

You can get your NIRI from the Revenue District Office (RDO) where you are registered. You need to show them your Certificate of Registration (COR) or Form 2303 and a valid ID.

You need to put up your NIRI in visible places of your business place or online platform. You also need to issue receipts or invoices for every sale or service you make.

What happens if you don’t follow NIRI?

Under the RMO 7-2015 or the revised Schedule of Compromise Penalties of BIR, failure to display the poster or Notice to the Public to demand receipts/invoices, there shall be a fine of not more than 1,000 or imprisonment of not more than six (6) months, or both. (NIRC Sec. 236/275)

For failure or refusal to issue receipts or sales or commercial invoices; there shall be a fine ranges from P1,000 to P50,000 depending on how much you sell or earn and imprisonment of not less than four (4) years. (NIRC Sec 264)

You may also face other penalties for breaking other rules of the National Internal Revenue Code (NIRC), such as surcharge, interest, and compromise penalty for late filing or payment of taxes.

Where can you learn more about NIRI? You can learn more about NIRI from these sources:

• BIR website

• RMO No. 43-2022

• RR No. 10-2019

• RMC No. 60-2020

NIRI is a big change that affects all businesses and online sellers in the Philippines. It aims to promote tax compliance and collection, as well as customer protection and awareness. As responsible taxpayers and buyers, we should follow NIRI and support the BIR’s initiatives.