As the new year begins, it’s crucial for businesses to stay on top of their tax compliance requirements. One important task is the submission of the annual inventory list, as mandated by the Bureau of Internal Revenue (BIR) under Revenue Memorandum Circular (RMC) No. 57-2015.

Step-by-Step Guide to Inventory List Submission

What is RMC 57-2015?

RMC 57-2015 provides guidelines on the submission of inventory lists and other reporting requirements. This circular aims to ensure that financial accounting information is accurately reported to the BIR, enhancing the quality and reliability of data for better monitoring and analysis.

Who Needs to Comply?

The circular applies to companies maintaining inventories of stock-in-trade, raw materials, goods in process, supplies, and other goods. This includes sectors such as manufacturing, wholesaling, distributing/retailing, real estate, and construction.

Formats and Downloadable Resources

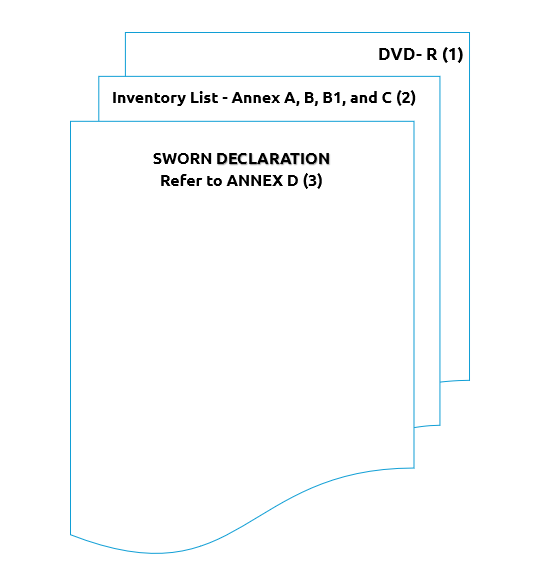

-Inventory lists must be submitted in both hard and soft copies.

-The soft copies should be stored on a Digital Versatile Disk-Recordable (DVD-R) and accompanied by a notarized certification.

BIR RMC 57-2015 – Revenue Memo Circular – Submission of Inventory List

Annex A – For Retail and Manufacturing Company – Merchandise, Raw Materials, Goods in Process, Finished Goods Inventory

Annex B – For Real Estate Company – Inventory of Saleable Units with Corresponding Cost Per Project

Annex B1 – For Real Estate Company – Inventory of Saleable Units Per Project with the Corresponding Trade Accounts Receivable Reconciliation

Annex D – Sworn Declaration

Deadline of Submission

The inventory list should be submitted within 30 days following the close of the taxable year. If your close of a taxable year is December 31st, then the deadline of submission is January 30th.

Consequences for Non-Compliance

Failure to file the inventory list on time can result in significant penalties. According to the BIR, the penalties for non-compliance include:

• A fine ranging from ₱1,000 to ₱25,000 per year.

• Additionally, failure to submit the required documents may lead to further delays and complications in your business operations.

The National Internal Revenue Code (NIRC) of 1997, as amended, specifically states the following:

SEC. 250. Failure to File Certain Information Returns.– In the case of each failure to file an information return, statement or list, or keep any record, or supply any information required by this Code or by the Commissioner on the date prescribed therefor, unless it is shown that such failure is due to reasonable cause and not to willful neglect, there shall, upon notice and demand by the Commissioner, be paid by the person failing to file, keep or supply the same, One thousand pesos (1,000) for each failure: Provided, however, That the aggregate amount to be imposed for all such failures during a calendar year shall not exceed Twenty-five thousand pesos (P25,000).

SEC. 255. Failure to File Return, Supply Correct and Accurate Information, Pay Tax Withhold and Remit Tax and Refund Excess Taxes Withheld on Compensation. – Any person required under this Code or by rules and regulations promulgated thereunder to pay any tax make a return, keep any record, or supply correct the accurate information, who willfully fails to pay such tax, make such return, keep such record, or supply correct and accurate information, or withhold or remit taxes withheld, or refund excess taxes withheld on compensation, at the time or times required by law or rules and regulations shall, in addition to other penalties provided by law, upon conviction thereof, be punished by a fine of not less than Ten thousand pesos (P10,000) and suffer imprisonment of not less than one (1) year but not more than ten (10) years.

Any person who attempts to make it appear for any reason that he or another has in fact filed a return or statement, or actually files a return or statement and subsequently withdraws the same return or statement after securing the official receiving seal or stamp of receipt of internal revenue office wherein the same was actually filed shall, upon conviction therefore, be punished by a fine of not less than Ten thousand pesos (P10,000) but not more than Twenty thousand pesos (P20,000) and suffer imprisonment of not less than one (1) year but not more than three (3) years.